Americans love beer, and with thousands of options on the market from breweries in all 50 states, how much we pay for those offerings can vary significantly. From the ingredients used, to brewing techniques, labor, and even the location of the brewery itself, multiple factors combine to determine a beer’s sticker price. Then there’s each state’s alcohol taxing policy to consider. And more specifically, each state’s excise tax.

In addition to excise tax on beer being collected at the federal level, ranging from $0.11 to $0.58 per gallon, each state collects its own excise tax, levied directly on the manufacturer, retailer, or wholesaler of the beverage, depending on the state. As such, excise tax, unlike sales tax, is already included in a beer’s price before consumers ever reach the register.

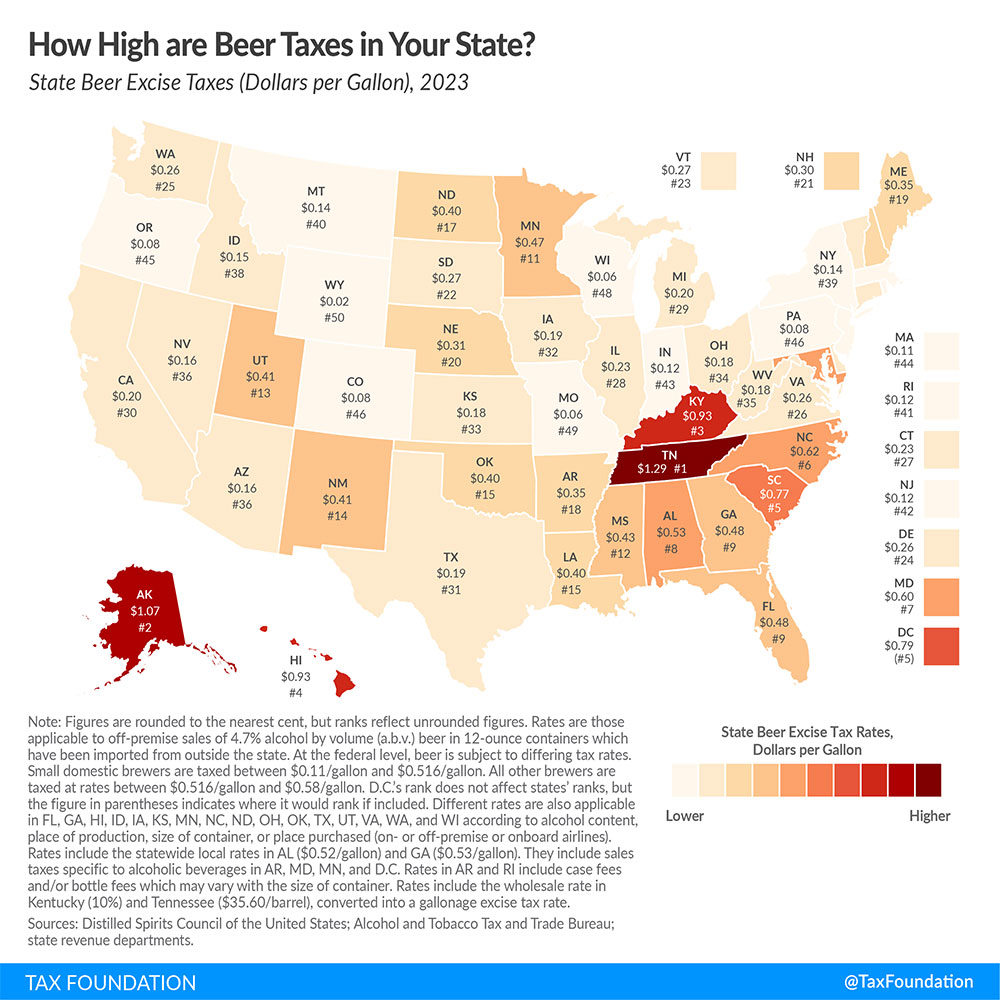

According to an annual report compiled by the Tax Foundation, those enjoying brews in Tennessee are forced to shell out the highest excise tax — a whopping $1.29 per gallon. Rounding out the top three are Alaska, with an excise tax of $1.07 per gallon, and Kentucky and Hawaii, tied for third at $0.93 per gallon.

On the other end of the scale, consumers in Wyoming enjoy the lowest state excise tax at just $0.02 per gallon. Midwesterners in Missouri and Wisconsin are tied for second lowest, with excise tax coming in at $0.06 per gallon, and Colorado, Pennsylvania, and Oregon are tied for third lowest at $0.08 per gallon.

Curious to see how much excise tax is baked into beers in your home state? Check out the Tax Foundation’s infographic below.

This story is a part of VP Pro, our free content platform and newsletter for the drinks industry, covering wine, beer, and liquor — and beyond. Sign up for VP Pro now!